Historical Development

Annual Performance* (%)

| 1 Yr | 3 Yr | 5 Yr | 10 Yr | 15 Yr | 12.15 | 3.97 | 3.77 | 6.14 | 6.90 |

|---|

Cumulative Performance* (%)

| 1 Yr | 3 Yr | 5 Yr | 10 Yr | 15 Yr | 12.15 | 11.90 | 18.85 | 61.37 | 103.47 |

|---|

Performance* (%)

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Global Balanced USD | 2.42 | -12.51 | 21.26 | 9.21 | 1.72 | 9.45 | 7.16 | 7.84 | 2.78 | 3.69 | 5.60 | -7.40 | 15.71 | -1.14 | 5.05 |

| Global Balanced EUR | 2.42 | -12.51 | 21.26 | 9.21 | 1.72 | 9.45 | 7.15 | 7.84 | 2.78 | 3.69 | 4.13 | -9.74 | 12.00 | -2.94 | 4.26 |

| Moderate Allocation - Global | 0.84 | -20.62 | 14.37 | 5.81 | -6.00 | 8.59 | 6.52 | 6.79 | 2.51 | 3.03 | 4.45 | -6.88 | 12.53 | 2.37 | 4.46 |

* The figures shown are based on backtesting the fund over 20 years until the 15th March 2017. These performance figures reflect what a client would have received net of fees.

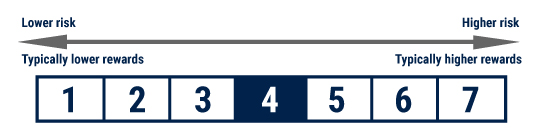

Risk

Funds Platforms