Historical Development

Annual Performance* (%)

| 1 Yr | 3 Yr | 5 Yr | 10 Yr | 15 Yr | 4.25 | 2.60 | 3.34 | 5.50 | 6.68 |

|---|

Cumulative Performance* (%)

| 1 Yr | 3 Yr | 5 Yr | 10 Yr | 15 Yr | 4.25 | 7.79 | 16.69 | 54.98 | 100.25 |

|---|

Performance* (%)

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| US Income USD | 14.60 | 12.21 | 5.21 | 13.76 | 4.63 | 7.56 | -0.93 | 6.76 | 9.49 | -6.23 | 14.91 | -4.02 | 0.70 |

| US Income EUR | 15.17 | 12.84 | 5.73 | 14.32 | 5.20 | 8.05 | -0.48 | 7.29 | 9.71 | -6.86 | 12.10 | -5.72 | 0.48 |

| Allocation - 30% to 50% Equity | 20.77 | 10.03 | 1.70 | 9.40 | 7.23 | 4.02 | -2.32 | 6.62 | 9.86 | -5.04 | 14.81 | 8.86 | 5.24 |

* The figures shown are based on backtesting the fund over 20 years until the 15th March 2017. These performance figures reflect what a client would have received net of fees.

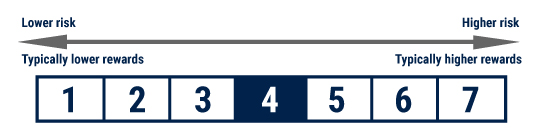

Risk

Funds Platforms